Introducing Arweave’s Tech Ecosystem (Part 1)

This post is based on the speech that outprog, the everFinance’s founder who proposes the SCP (Storage-based Consensus Paradigm) theory, gave on BeWater Live. It is intended to give you the whole picture of Arweave’s tech ecosystem by delving into Arweave, SmartWeave and SCP, as well as the two-layer model that integrates PoW and PoS.

This post is divided into three parts, each of which centers on the following content:

- Why is perpetual storage economically viable

- How does Arweave ensure miners store all the data

- Blockweave technology

- Implicit incentive mechanism

- SmartWeave

- Storage-based Consensus Paradigm

- The Web3 Era of Infinite Scaling

- everPay Architecture

3. The Two-layer model that integrates Permanent Storage and PoS

- The Design of KYVE

- The Design of Koii that Integrates Permanent Storage and Pos

- Conclusion

Part1: How Arweave Works

This is the first part of “Introducing Arweave’s Tech Ecosystem”.

Hello, everyone! I dove into the blockchain industry in 2018 as a developer at imToken to work on the DEX Tokenlon and its iterations. During this period, I had been studying DeFi, I became an early user and researcher of the popular Uniswap as well as Compound.

When developing for imToken and interacting with DeFi apps, I encountered numerous problems. For example, managing seed phrases and paying miner fees is hard for users to comprehend. Over the past few years, I have been trying to recommend some friends of mine working at Alibaba and banking to use decentralized light wallets. However, it turns out that decentralized wallets are still desperately unpopular for their high user threshold. Fortunately, I saw a new direction for lowering the user threshold when I learned about SmartWeave, which is Arweave’s smart contract protocol, from UncleMeow, and the perpetual storage blockchain Arweave from ZengMi at a seminar held by SparkPool last July.

Since the established public chains like Ethereum are inherently unable to provide a premium experience for ordinary users at the infrastructure level, even the most elaborately devised products cannot remove obstacles to the use of blockchains. However, Arweave has the potential to become the basis of a new paradigm, making the blockchain world truly open to ordinary users.

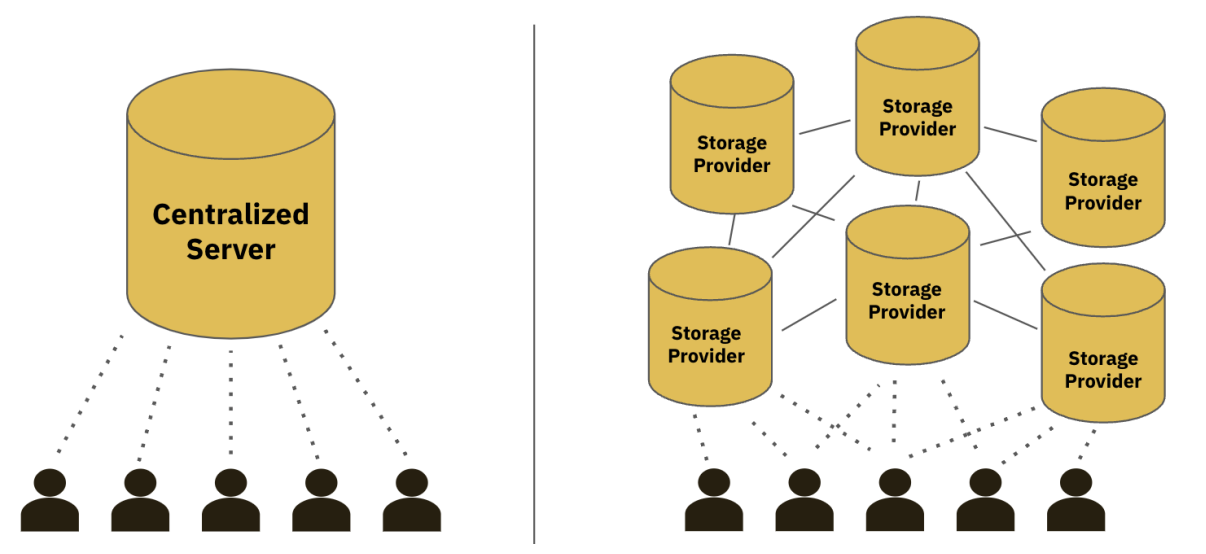

When you perpetually store a file in Arweave, the file data will be stored by hundreds of nodes and can be accessed by Arweave gateway or any of the Arweave nodes.

Before being part of the blockchain industry, I studied IPFS and learned how to use distributed hash tables to retrieve data across the network in a decentralized way. However, IPFS has its own flaws for lack of an incentive layer for file data storage. For example, when your server shuts down, your file might disappear if it is not synchronized by the network.

Arweave builds a new mechanism for perpetual storage. What makes it different from Filecoin is that it charges a one-time, up-front fee for perpetual storage, which is made possible by its unique theoretical model.

1 Why is perpetual storage economically viable?

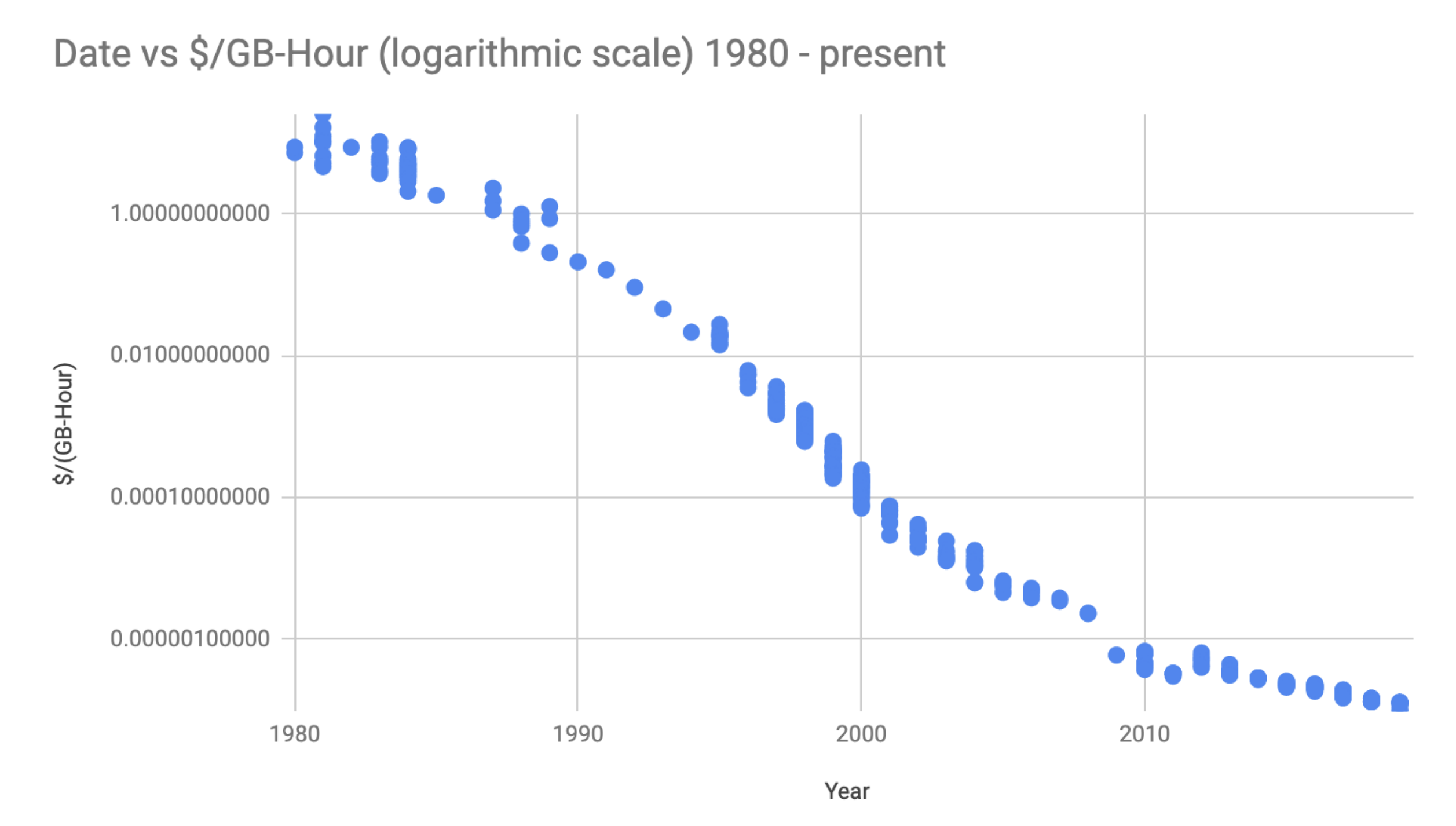

To answer this question, we need to understand the fact that the storage cost is decreasing over time, which conforms to Moore’s law. According to official statistics, the storage cost reduces by nearly 30% every year. This makes it possible for us to calculate the total cost of perpetual storage, which converges to a constant as the storage cost keeps going down. In Arweave, the constant is weighted to determine the fee charged for storing data permanently.

2 How does Arweave ensure miners store all the data?

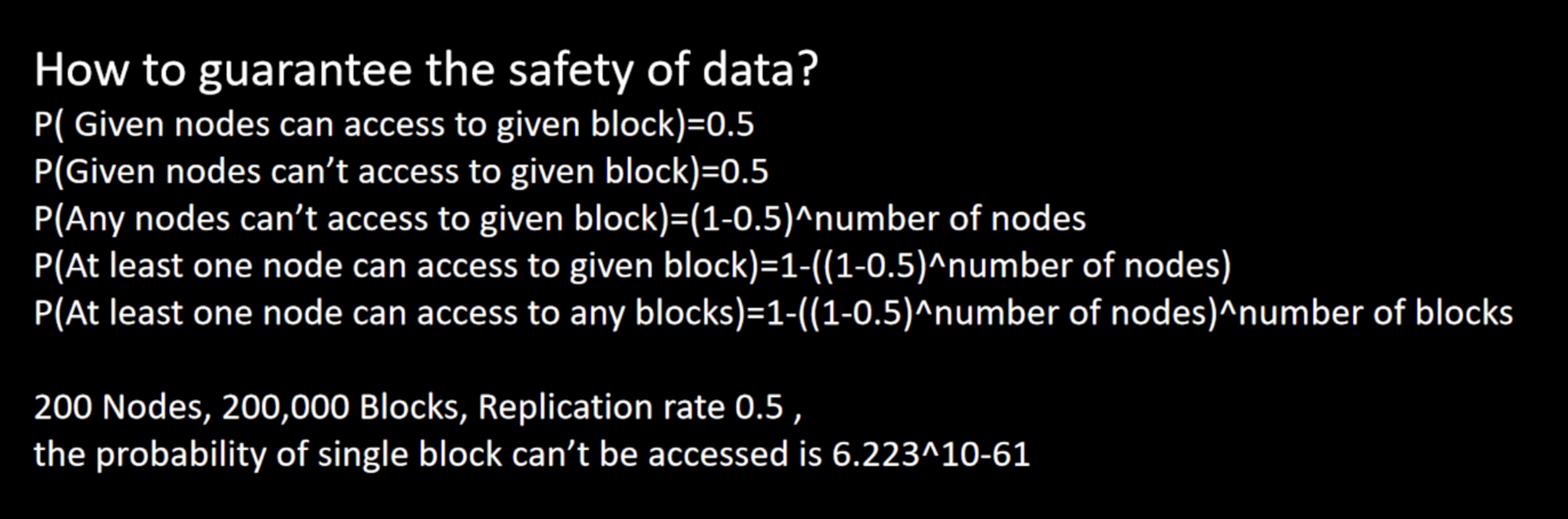

So how does Arweave prevent the loss of files stored in it? Behind it is data staking at play.

On Arweave, data is deemed valid after it is included into the chain. Miners can stake any amount of valid data, for example, 10 MB or even 20 TB (i.e. the entire data size of the network). For miners, the more data they store, the more AR tokens they can obtain. This makes it so that miners are incentivized to store data in Arweave.

3 Blockweave technology

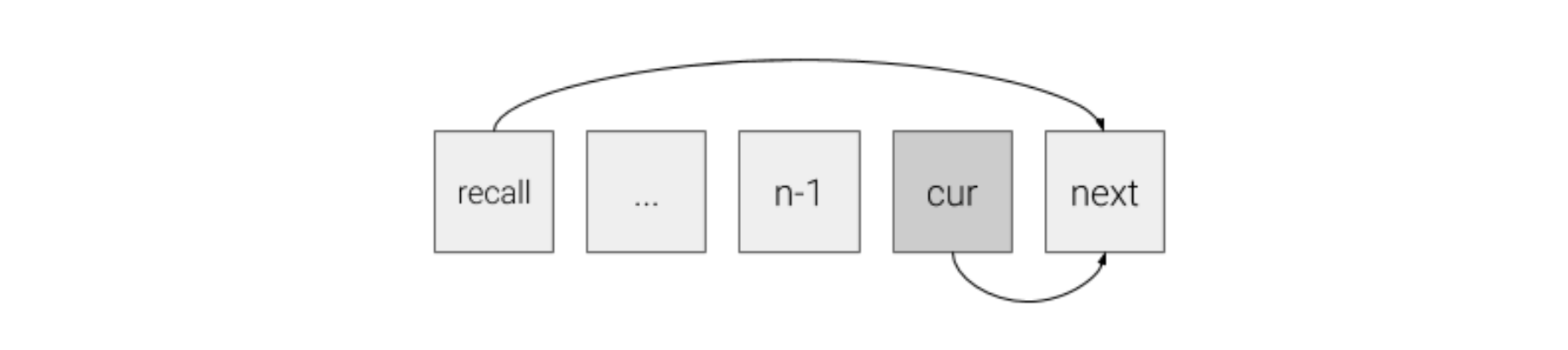

The core technology that powers Arweave is the blockweave. How does the blockweave work?

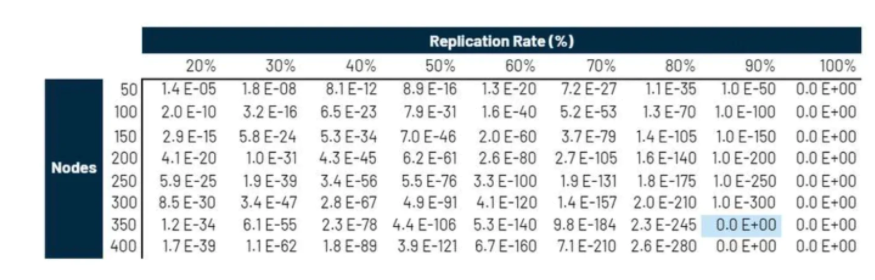

Simply put, it requires a random historical block to create a new block. It means that the miner who stores the largest number of historical blocks is the most likely to mine a new block. If a miner does not store the required historical data, the hashrate that he needs to mine a new block will increase exponentially.

That being said, storing more data is the optimal and most profitable option for miners.

4 Implicit Incentive Mechanism

Besides, there is an implicit incentive mechanism on Arweave that protects users against file loss. When a chunk of scarce file data is required in a new block, the miners that happen to store it have advantages over other miners, who have to consume more computing power to solve the PoW puzzle.

Obviously, storing scarce data makes it faster for miners to mine a new block. In order to increase their competitiveness in mining, miners are incentivized to synchronize scarce data, which will become no longer scarce.

As a consequence, the files you store in Arweave will be spread all over the network in a distributed way to avoid being lost to the greatest extent.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

官方首次对稳定币定性,稳定币的幻想可以结束了

也意味着行业从此不需要再围绕“灰色可能性”反复试探。来源:曼昆区块链法律服务这是28日的一场会议,重要程度远超新闻标题本身。公安部、网信办、中央金融办、两高、外管局、证监会、金融监管总局等一整套“国家

-

Hotcoin Research |本轮牛市结束了吗?深度解读比特币四年周期的“变”与“不变”

Hotcoin Research |本轮牛市结束了吗?深度解读比特币四年周期的“变”与“不变”一、引言:周期规律的“变与不变” 比特币每隔约四年减半一次供应增量,这一机制也塑造了加密市场的周期起伏。然而,自2024年4月完成第四次减半以来,比特币价格和整个加密市场的表现却呈现出不同以往的新特点

-

当市场陷入极度恐惧,谁在逆势抄底?Hotcoin Research | 2025 年 11 月 24 日-28 日

当市场陷入极度恐惧,谁在逆势抄底?Hotcoin Research | 2025 年 11 月 24 日-28 日加密市场表现 当前,加密货币总市值为 3.09 万亿美元,BTC 占比 58.5%,为 1.8 万亿美元。稳定币市值为 3061 亿美元,最近7日增加 1.08%,稳定币数量在本周逆转,开始出现正增长

-

BiFinance币汇将捐赠100万港元,驰援香港大埔火灾救援及重建工作

BiFinance币汇将捐赠100万港元,驰援香港大埔火灾救援及重建工作BiFinance紧急启动公益援助计划,将捐赠100万港元 用于救助与慰问,支持受困群体的生活安置、应急需求及基本物资保障,以确保援助与关怀能够直达最需要帮助的人。 在救助的同时,BiFinance也

-

央行首次重磅定调稳定币,市场将向何处去?

央行首次重磅定调稳定币,市场将向何处去?作者:蔡鹏程,钛媒体 编辑:刘洋雪,钛媒体11月29日,中国人民银行官方发布文章《打击虚拟货币交易炒作工作协调机制会议召开》,对于虚拟货币及稳定币进行了最新论述。 文章对稳定币进行了最新定调,“稳定币

-

Cobie:长线交易

Cobie:长线交易文章作者:Thejaswini M A 文章编译:Block unicorn前言 2012 年,乔丹·菲什(Jordan Fish),也就是 Cobie,当时有 200 美元和一个难题。 他当时是布里

-

钱志敏带走的 400 亿比特币,能归还中国吗?

“我们的核心诉求非常明确——物归原主,也就是归还中国受害者。”来源:中国新闻周刊“钱志敏”,这个名字葛秋已经有好几年没看到了,围绕这个名字以及背后的蓝天格锐投资案,讨论已逐渐沉寂。直到近两个月,她所在

-

难怪巴菲特最后押注了谷歌

“谷歌把全链条攥在自己手里。它不依赖Nvidia,拥有高效、低成本的算力主权。”作者:马泪泪来源:吴晓波频道CHANNELWU巴菲特曾说,“永远不要投资一家你无法理解的企业”。然而在“股神时代”即将谢

- 成交量排行

- 币种热搜榜

OFFICIAL TRUMP

OFFICIAL TRUMP

泰达币

泰达币 比特币

比特币 以太坊

以太坊 Solana

Solana USD Coin

USD Coin First Digital USD

First Digital USD 瑞波币

瑞波币 币安币

币安币 狗狗币

狗狗币 大零币

大零币 莱特币

莱特币 Sui

Sui ChainLink

ChainLink Avalanche

Avalanche LUNC

LUNC FIL

FIL ZEN

ZEN OKB

OKB ETC

ETC NEAR

NEAR YGG

YGG FTT

FTT AR

AR